Deloitte has released its 10th annual Media Consumer Survey 2021, focusing on the audience behaviours, attitudes and trends in digital media and entertainment subscription services. While most of the survey is about the increase in subscription video on demand (SVOD) use and options (largely accelerated by rolling COVID-19 lockdowns), digital news subscriptions get a bit of a look-in.

There’s also some interesting information around consumer attitudes toward advertising and generational media consumption habits that will be of interest to special interest publishers.

Consumer advertising attitudes

The 2021 survey sees Australian’s as still largely adverse to advertising. Nearly half (46 per cent) of those surveyed said they actively block apps and websites from tracking their data, and 28 per cent use ad-blocking software.

When it comes to video, 80 per cent said they tend to skip online video ads if given the option, while 49 per cent of respondents won’t wait to watch the content if they can’t skip the ad.

Does this mean that consumers are willing to pay for content without advertising?

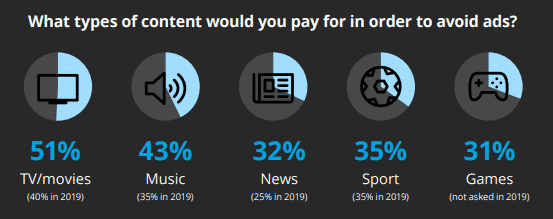

When it comes to digital news and magazine services, 32 per cent of respondents said yes. This falls behind TV/movies and music services where the attraction of no advertising is a major paid subscription driver.

“While advertising avoidance remains a major consideration, it is not the sole factor in attracting a paid digital news subscriber base,” state report authors Will Castles and Leora Nevezie.

So what is?

What are the factors that are likely to lead to news subscriptions?

Of respondents, 4 per cent have digital news or magazine subscriptions.

This is despite the challenges of 2020 and 2021 making news content a household staple. Television remains the most frequently used news source for consumers in the Mature, Boomer and Gen X demographic, while younger generations are split more evenly across sources with social media sites prevalent (29 per cent of Millenials and 40 per cent of Gen Z).

But Castles and Nevezie state the challenges of creating sustainable digital news revenue models that complement advertising remain. They pose the questions:

“With subscriptions critical to this revenue ecosystem, who should news services focus on to grow subscribers, and what are the key drivers for signing up and remaining subscribed?”

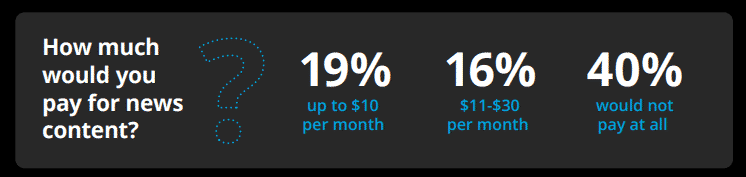

Interestingly, it’s the younger generation: 53 per cent of Millennials and 55 per cent of Gen Z respondents indicated they would pay for online news content. When it comes to price, 40 per cent of Millennials and 38 per cent of Gen Z respondents said they were willing to pay up to $10 per month.

“This propensity to pay may be due to these generations being almost ‘digital subscription natives’, with subscription entertainment so abundant for them that virtually every Gen Z and Millennial respondent (95 per cent and 93 per cent respectively) have at least one paid entertainment subscription service,” the authors explain.

“On the other hand, the more traditional advertising models will likely continue to suit the older generations who prefer to access their news on television and are the least likely to pay for online news content.”

Of the older generations, 87 per cent of Matures, 73 per cent of Boomers, and 60 per cent of Gen X said that they would not pay for online news content.

“Striking a balance between paid content behind ‘paywalls’ and free advertising-driven content in front of them is critical to converting audiences to a paid subscription model, and simply having an ad-free version of content is unlikely to have a major impact,” the report states.

In fact, the survey found that there is a strong expectation on the type of content that should remain free (breaking news, matters of urgent national importance and weather).

During 2020 and 2021, ‘freenium’ models with this content sitting in front of a paywall were more successful in converting younger generations (35 per cent of Gen X, 42 per cent of Millennials, 31 per cent of Gen Z) compared to Matures (11 per cent) and Boomers (15 per cent).

Deloitte found that high-quality content and trust in the news source are the main drivers to pay for news.

“The last 18 months have further heightened our expectations on trust and quality of news content across all generations, with 56 per cent of respondents saying they value trusted news sources more highly than before the pandemic. This was even higher for the potentially lucrative Millennial and Gen Z target markets,” Castles and Nevezie note.

Despite this, only 26 per cent of respondents used paid news/newspaper sites more during the pandemic. And while 64 per cent of respondents said they were concerned about fake news in their feed, social media continues to be a major source of news for younger generations.

Castles and Nevezie suggest that tapping into these audiences through social media by placing a focus on trust and quality could provide a pleasing result revenue-wise.

The takeaways to drive digital subscriptions in 2022

- Tap into younger, “digital subscription native” audiences

- Strike the right balance of content behind and in front of paywalls

- Leverage social media to provide quality, trusted content

Deloitte’s Media Consumer Survey is conducted by an independent research organisation using self-reported survey data from more than 2,000 consumers surveyed in Australia. Each year the survey is run, new questions or response options are added and some older ones removed, allowing Deloitte to explore new and emerging behaviours and trends in media and entertainment consumption.

To access the full report, including infographics on generational media preferences, visit Deloitte’s Media Consumer Survey webpage.