PwC Australia’s Australian Entertainment & Media Outlook 2020-2024 may include a fairly bleak outlook for consumer magazines, but it also has some very good insights for those willing to innovate and diversify. Here are the key takeaways for Australian magazine publishers.

The 19th edition of the Australian Entertainment & Media Outlook 2020-2024 focuses on the impact of the COVID-19 pandemic on Australia’s rapidly transforming entertainment and media industry.

The report points to temporary and likely permanent changes to consumer habits, consumer revenue, and advertising investment brought about by COVID-19 across 12 industry entertainment and media industry segments, including internet advertising and consumer magazines.

The key points for consumer magazine publishers:

- Advertising and consumer magazine revenue is expected to decline, but there are opportunities to offset this by pursuing digitisation, innovative product extensions, and brand collaborations;

- Internet advertising is expected to remain stable but advertisers will demand more effective campaigns across multiple channels with robust data sets;

- Ad-free business models, such as digital subscriptions that are proven within the news and entertainment space, could offer hope for magazine publishers and targeted media brands

- The quality of products and depth of direct-to-consumer relationships will be key to gaining and maintaining a competitive advantage.

Consumer magazines need to digitise and diversify

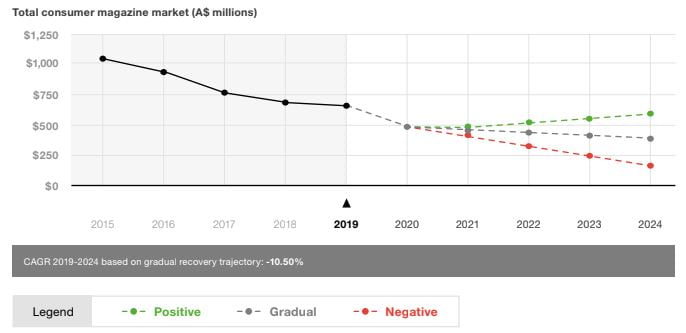

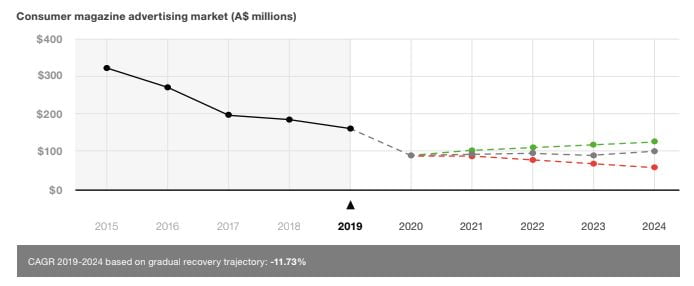

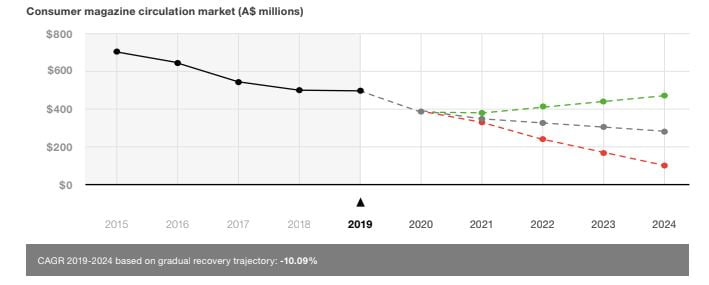

PwC’s outlook for consumer magazines is bleak. Total consumer magazine revenue is predicted to decrease from $663 million in 2019 to $381 million in 2024 – driven by continued declines in advertising and consumer revenue.

The data tracks three scenarios:

- Positive: a more rapid return to pre-COVID-19 advertising and consumer expenditure, opening of international borders, and minimal ongoing negative impact from the pandemic.

- Gradual: allowing for 18-24 months of recovery and a modest return to the pre-COVID-19 trajectory.

- Negative: linked to health factors, this scenario includes ongoing international lockdown, negative business sentiment, and delayed vaccine implementation.

But this data is mostly a reflection of the instability of large, generalist consumer magazine publishers. PwC points to three factors as reshaping Australia’s magazine industry:

- the merger of Pacific Magazines and Bauer Media (which reportedly gave Bauer control of 85-90 per cent of the consumer magazines in Australia);

- the subsequent sale of Bauer to Mercury Capital (which resulted in the permanent closure of some titles); and,

- the accelerated decline in advertising revenue within consumer magazines focused on industries affected by the pandemic (such as travel).

“The future of the industry remains unclear, but post-COVID-19 recovery will rely on leveraging the strength of existing brands, and diversifying revenue through digital channels,” the report states.

It suggests product extensions, brand collaborations, and extending revenue opportunities to other media formats and product categories as ways for consumer magazine publishers to further monetise their titles. This recommendation is in line with PwC’s previous report, which highlighted the importance of identifying targeted audience segments to engage and grow product extensions.

“Further, the magazine industry may look to evolve through increased digitisation of existing properties, including a renewed focus on direct to consumer and subscription models, in line with movement in the broader entertainment and media industry,” states the report.

Internet advertising will remain stable but audience data and proving effectiveness are key

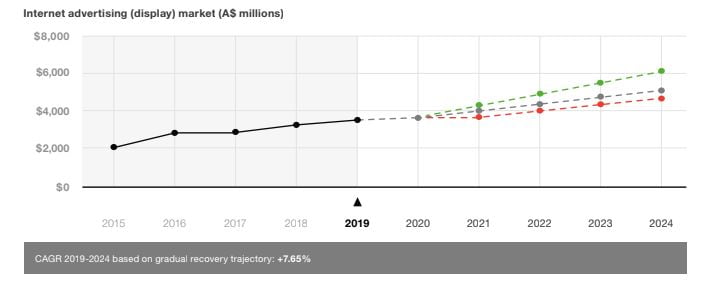

Australian internet advertising revenue is forecast to remain flat in 2020 at a 0.8 per cent compound annual growth rate (CAGR). The report states that, despite this, some advertising formats and platforms have gained share, while others have declined due to the impact of COVID-19.

PwC points to the accelerated digital disruption brought about by the pandemic as bolstering the market, with video advertising formats performing particularly well. Classifieds, on the other hand, recorded the biggest decline.

For display advertising, 41 per cent was bought from agencies using insertion orders, 44 per cent through programmatic methods, and 15 per cent bought directly from advertisers.

PwC predicts internet advertising to recover steadily, with a predicted CAGR of 4.38 per cent over the next five years based on the ‘gradual’ recovery scenario.

However, the report warns that Australian publishers need to pursue digital transformation in order to make up for shortfalls in traditional advertising revenue, and compete against larger digital platforms such as Apple and Facebook.

“Not everyone has benefited commercially from this shift in consumption, with the big getting bigger, and the bifurcation of the industry being accelerated.”

In addition, PwC points to the “proliferation of new platforms, channels and formats” that continue to dilute consumer attention, “meaning advertisers must be more savvy about their usage of channels to deliver reach”.

More than ever, the report states, “media companies must look beyond those with whom they compete for advertising revenue, and redefine their competitive set to include all platforms and companies that command consumer attention”.

The report suggests five areas to successfully secure advertising dollars:

- Diversify digital advertising options

- Reach your target audience at scale

- Know your audience, with the ability to provide rich audience data sets

- Measure and provide evidence of the impact of advertising sold

- Where possible allow advertisers to leverage volume discounts and drive efficiency in the transaction.

COVID-19’s acceleration of ad-free business models

Overall, the Australian entertainment and media advertising revenue is expected to fall by 11.3 per cent. The report points to the impact of COVID-19’s increased economic pressure on advertising and marketing investment, and the limited ability of some industries to operate in a normal manner.

But PwC also notes that advertising revenue is expected to decline based on entertainment and media companies’ “increased tendency to monetise their content via direct to consumer revenue, rather than advertising”.

PwC says that, while COVID-19 has put business models under pressure, consumer demand for entertainment and media products and services hasn’t declined.

“We are seeing consumers and businesses adapt in parallel, and the industry is reconfiguring in order to meet this new shape of demand. The ongoing challenge for entertainment and media companies lies in capturing their share of consumer attention, and the subsequent monetisation of these audiences,” states the report.

“As consumption habits continue to evolve, the global industry is experiencing a major shift, as consumer revenue outstrips advertising revenue in the forecast period, perhaps for good.”

News and entertainment digital subscriptions are proving popular and offer an opportunity for magazine publishers

PwC states that the increase in subscription-based entertainment and media business and the rise in Australians paying for news content has demonstrated that ad-free models can work. Digital newspaper consumption is forecast to continue to grow to $535 million in 2024, at a CAGR of 11.93 per cent.

“We expect growth in consumer revenue throughout the forecast period, as incumbent media companies continue to diversify their product offerings, pursuing ad-free models, and new players enter the market and command their share of consumer attention.

“Subscription-based models are likely to be appealing to the new generation of consumers who have been brought up to view advertisements as an annoyance, to be skipped or avoided who are increasingly demanding personally-curated, individualised and on-demand experiences.”

The report states that consumers will favour media products that personalise content for their audiences.

“Consumers are willing to pay, but only if the content resonates with them and they can consume as much as they want.”

PwC Australia’s Australian Entertainment & Media Outlook 2020-2024.

“As the subscription-based entertainment and media business models evolve and mature, both the quality of products and depth of these direct-to-consumer relationships will be key to gaining and maintaining a competitive advantage.”

To read the Australian Entertainment & Media Outlook 2020-2024 in full, visit the PwC website.