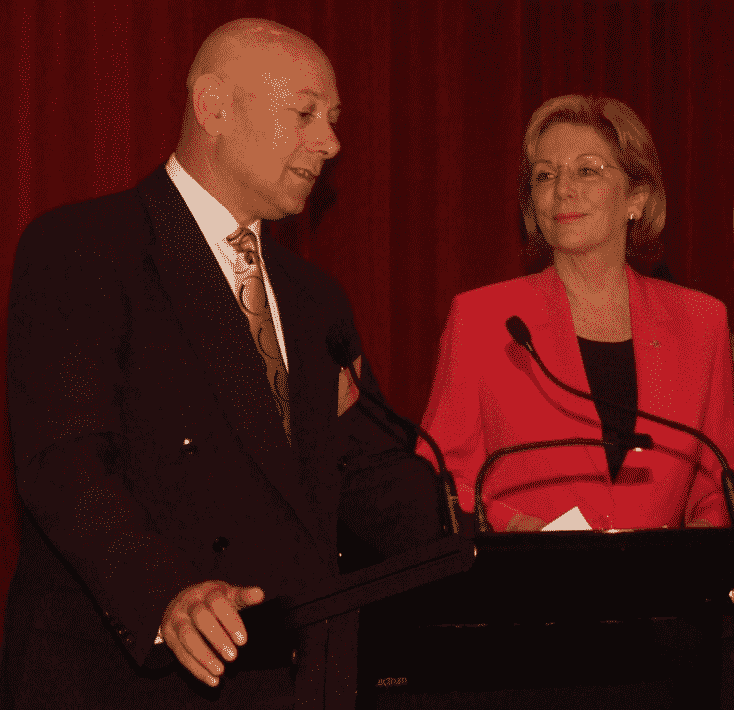

There may not be a more well-known person in Australia’s niche media space than media consultant John Blondin. He’s helped many niche publishers realise the full value of their media brands. Here, he talks to TMSN about how to build equity in a media asset.

Media consultant John Blondin has been involved in Australia’s media market for over 40 years, having published award-winning B2B, B2C and custom magazines in the business, hospitality, liquor and sports industries.

He was Chairman of Publishers Australia, the former industry body representing B2B, B2C, custom and digital publishers within Australia, and remained on the board for over 10 years.

In 2009, he was awarded the organisation’s highest individual honour, The Pinnacle Award, based on “recognising excellence, integrity and innovation in promoting, marketing and raising the profile of the specialist media publishing sector”. In 2011, he was inducted into the Publishers Australia Hall of Fame.

He’s also been honoured with a Fellowship of the Australian Marketing Institute.

Since selling his Australian publishing company, and soon after his New Zealand operation, Blondin established his media consultancy business, which provides marketing and media advice with a focus on helping media owners develop successful exit strategies and navigate the media mergers and acquisitions (M&A) market.

“A lot of what I do involves working with small to medium enterprises (SMEs) on their plans to either exit their assets, exit some of their assets, or build additional equity in their brands with a view down the track to exiting,” he says.

“And in building an exit strategy, sometimes underneath their platform, there’s other assets where the company hasn’t realised their full potential. Examples could be an interesting database which would allow the brand to extend into another sector, or a brand extension that allows them to communicate to a wider audience, and in some instances a collaboration with an existing client or prospect who sells to that wider audience (rather than just pitching them an advertisement).”

Blondin explains that a byproduct of this work means a lot of publishers see him as an introduction to others.

“I try to marry certain publishers together when their brands match each other or if I know a publisher who wants to extend into another sector, which could be of interest. If that happens, I’m involved in and monitor the process and broker the sale as well.”

TMSN Editor Lyndsie Clark caught up with Blondin to chat about realising and revitalising the value of media assets, and the shift in the media market that is being compounded by COVID-19.

Lyndsie Clark: What are some of the trends that you are seeing in the magazine market?

John Blondin: Today, it’s important to remember that it is a media communications market, not a magazine market, and it relates to a suite of communication products compared to days gone by where the focus tended to be on a magazine. There’s distinct media markets in the consumer and B2B space, and then there’s events and other opportunities that can dovetail into those markets.

There’s traditional publishers that really haven’t embraced digital disruption in a manner in which they possibly should have. And generally, they are smaller publishers who are very emotionally connected to their brands.

Those small publishers are the ones that are struggling because they saw their magazine portfolio as being their payback, in a superannuation-type manner, to all the years that they’ve spent developing their product.

Then, there are other publishers who are developing their brand to include different communication vehicles. And they’re focusing on reach, quality content, engagement, and growing brand extensions to their magazine. They are exploiting opportunities within the digital space. They go into the event space. They go into seminars, create forums, podcasts, online workshops and look at collaborations to drive revenue.

LC: What are the areas that publishers should focus on to build equity in their brand?

JB: Obviously publishers have got to focus on revenues, but to focus on revenues you’ve got to work out where the revenue sources come from. Creative thinking in pushing compelling propositions to an existing audience can, and is, paying dividends for many.

Traditionally, publishers would identify advertising as a key revenue source. But if you look at Zenith’s most recent Advertising Expenditure Report, magazine ad spend is going to be down 20 per cent globally in 2020, and another 20 per cent the next year.

But there are a lot of new ways to generate revenues. A lot of publishers who are chasing the advertising dollar probably don’t realise that those they’re chasing could collaborate with them in a better, more productive and more profitable manner than just paying for a display ad and a couple of banners on an EDM.

By forming a collaboration or a joint venture, a solid relationship can develop to grow the media brand and the client’s brand together, while still retaining autonomy through a defined alliance. It allows both collaborators to develop critical mass, i.e. more eyeballs and engagement, in a non-conflicting manner. Now when I say both, that can be two, three, 15, 20, or more collaborations. It’s a way of reinventing the value proposition of the communication product by providing more touchpoints with prospects, therefore deepening the relationship.

Apart from generating revenue, all communication has to be quality content to appeal to and engage an audience. And it has got to generate rich engagement, which can be critical mass, or in a B2B sector, reaching the right decision makers and purchasing influencers.

Reach, engagement, quality content, understanding your audience, knowing how to attract your audience, and knowing how to grow your audience. Retention is important, but acquisition is equally as important.

LC: You mentioned that many publishers are emotionally connected to their brands. How do you encourage those you work with to think about their media brands objectively?

JB: The important thing is to understand what the economy is doing, and not to feel as though you’re in a fortress and nothing’s really affecting you. We shouldn’t pretend that it’s business as usual because it’s not.

It depends on the moment in time when you decide to do a good forensic analysis of your business and determine exactly where you want to go in relation to the environment you’re working in. And it’s important to understand the impact of that environment on the people who traditionally were followers of yours, but have probably undergone a mind-shift or change because of the circumstances created, especially in this market.

Basically, unto thyself be true and know thyself. You’ve got to be true to yourself in what you’re doing and, sometimes take the emotional connection out of your brand and say: “This is a business. I shouldn’t have a love affair with what I’m doing. I should understand whether there are opportunities to pursue.”

I used to tell my sales teams: in order to sell what you want your prospect to buy, you have to see things from your prospect’s eye. The aim should not be to push, but rather pull together. A good relationship develops in this way.

The road to success is always under construction. Those who think they’ve made it will fall into a false sense of security. An enterprise, especially in media, has to be continually reviewing the business, its goals, and its positioning amongst various market forces.

The road to success is always under construction. Those who think they’ve made it will fall into a false sense of security.

John Blondin

Someone who’s got a good brand today can become complacent and find that an aspiring communications professional will see that brand as an opportunity and aggressively launch against it, and in a short time dilute the value of that asset. We’ve seen that happen so often.

Over the years I’ve seen good publishers fall by the wayside, I’ve seen great products fall by the wayside, and I’ve also seen ‘basket case’ products become really successful.

It depends on your attitude and the way you look at something; the way you view it, who you bring into it, who your confidants are, and how much you respect their opinion on where you want to go. A robust business plan with good human resources can deliver great results.

You’ve got to work out what you really want out of your business.

When I work as a media consultant, I try to take publishers out of “working in their products” to “working on their products”. And I can be pretty tough, but tactful, in how I go about it.

Two years ago, I was retained for six months to overview a company and it’s offerings in a difficult market. After a name change, human resource restructure and greater focus on building reach through a digital play, they have also launched in New Zealand. In the midst of this challenging time they are more than holding their own with a cash-flow positive enterprise.

LC: How do you think the economic environment created by the COVID-19 pandemic has changed the media market for publishers?

JB: In the last couple of weeks, I’ve had a number of publishers contact me looking to acquire. Some of them want firesale product and others want product that’s reasonably suited to their business. And that’s only in the last couple of weeks.

Aside from that, I think it’s got media executives thinking more about their business and working “on their business” because they’ve got more time to do it.

What’s been opportunistic has been the ability to look at where the markets are heading, and where some of the sectors are heading within those markets, and whether you can capitalise on your brand’s positioning in the market. Especially without a major financial commitment.

This might mean a slight variation from what you’ve been doing. It might be a brand extension, it could even be a change of name and proposition restructure.

As an example, over the next month, I’ll be working with a company that acquired a lot of reusable content but they’re not publishers. They have a small social media exposure, around 5,000, and their content covers wine, food and travel aligned to a popular European country. The travel component is going to be shelved for now because few are currently thinking about international travel as an investment proposition. But the popularity of the cuisine and restaurant sector that aligns with the food, wine and recipe content within Australia is quite massive. Two annual print publications and a significant digital play is on the table.

The owners of the content want to collaborate with a publisher who’s got the infrastructure to be able to promote it, take some equity in the brand, and a significant profit share in the brand.

It’s a project that can work well, because international food and wine in any environment is popular and is always of interest to a major sector of consumers. The opportunity can provide restaurants, product suppliers and aligned enterprises with an online platform to link with a critical mass and launch deeper into the market. Collaborative partnerships would be an obvious goal.

Opportunities like these exist for a media operator who has the infrastructure and wants a bolt-on product that can utilise their existing infrastructure in a cost-effective manner.

There’s also a lot of opportunities for publishers who have events associated with their products. Many are rethinking their model and gravitating to online events, and in doing so, recognising that it’s not going to generate the income that they were generating through live events.

But the reality is that the margins on virtual events can be reasonable because the costs are significantly less than what they would be for a live event. It again comes down to the quality of content and the audience numbers.

LC: Do you think most media brands are taking this opportunity to look at their business model and better their brands?

JB: There are so many SMEs in the communications space, not only in magazine or digital publishing, but also in the public relations sector as well, that are just surviving through JobKeeper. And some of the smarter ones have addressed where they want to be when JobKeeper payments finish. They’re giving themselves a good opportunity to springboard into 2021 in a much leaner and meaner manner.

After I look at their profit and loss reports, many of those that I talk to are working for their staff and their suppliers – and for the last year or so have never been working for themselves. If that goes on for another year, they won’t have any money at all, because they’re actually funding their business through funding other people through their own work. They’re working for others.

And there are others who I’ve talked with recently who are looking to sell their assets, but when they ask my opinion on the sales figure they could expect, they aren’t happy with the answer. I’ll provide a realistic figure based on the contribution to earnings the asset gives their business, and generally the amount that they’re after is significantly higher than the market price.

I have been doing these deals for several years and have a good handle on what a buyer looks for and how they value the business. A lot depends on the market sector, competition and what assets come with the brand.

Over my time in the media sector, I’ve come across some very smart operators. I’ve assisted some to sell off their assets so that they can retire, I’ve worked with private equity in the disposal of assets, publicly listed media companies, and others who started with a small portfolio and now turn over several million dollars each year. Some that I’ve worked with have completely transformed their business model, while others have reinvented their brand – virtually renovating and repainting their house to become more attractive and appealing.

This industry always holds potential.

This industry always holds potential. I’m also excited by the young blood that’s come in because some have really dynamic views of the market and are incredibly realistic, and have abundant energy and drive to pursue their goals.

LC: If a media brand is looking to sell, where does the value generally lie in their media assets?

JB: There’s a lot of elements associated with that question. It depends on the sectors, the marketplace, and what’s on offer. Critical performing staff and reputation add value as well.

For example, magazines alone don’t attract huge value unless their contributions to earnings are significant. There’s a lot of cost associated with producing a magazine. Buyers still look for opportunities even if there is minimal digital activity with the brand, but leveraging other assets can increase the equity value if there are oppotunities for growth.

In the consumer market, social media can play a big role as far as the reach is concerned by developing critical mass around that brand. And if that’s developed and demonstrates rich engagement, it can be monetised. In the B2B market it comes down to the quality of reader engagement not necessarily big numbers.

So there’s value in how a proprietor of a communication asset can look at the various components of that asset and create other assets from it, and as a consequence build equity in their structure. And, as a consequence of that, have more to offer when going to the market.

Many publishers come to me wanting to sell their brand or their company and I can see opportunities where some of them can afford to wait 6-12 months, and we work on a way in which we can enrich the brand to generate maybe 20 or 30 per cent more in value. It can then be offered to the market demonstrating the opportunity for additional upside.

It’s important to leave some fat in there because whoever wants to acquire a brand has their own reasons to acquire it.

At the end of the day, the seller can’t claim what the buyer wants to do with the brand. A lot of sellers of media assets will point to the opportunities that they see in their brand, but they’re not taking on those opportunities. The future owner will have to do that if they share the same view. So those opportunities can’t be claimed as part of the deal however the ideas do help.

That’s the interesting aspect associated with being able to promote a deal and create a compelling proposition to a buyer. Any information memorandum we produce presents a realistic overview of the industry and the positioning of the product and must be robust enough to withstand due diligence, especially from a financial perspective.

I’d say at least 75 per cent of companies that I’ve worked with don’t realise that they are sitting on certain assets that we incorporate into the information memorandum to make it a more valuable product. And, a lot of buyers do see it.

If I’m working on an acquisition, quite obviously, we look at those things from an acquisition point of view. And if the seller doesn’t see it, the buyer generally gets the benefit of that in the negotiation of the overall consideration of price.

LC: What kind of mindset or attitude does a publisher interested in selling their business need to adopt?

JB: It’s hard to be specific on profiling an individual or a business who wants to sell their brand because there are so many different dynamics and motivations at play.

I’ve dealt with companies like Cirrus Media who were owned by private equity; I’ve dealt with other brands that were owned by a university professor who was a major investor and the major decision-maker, and we had to deal with a private equity company in selling that brand.

I’ve just dealt with News Corp, and in that arrangement, you’re dealing with many different people across countries. I’ve had dealings with publicly listed media companies, one went into liquidation during the negotiations. Dealing with the liquidator was like walking through a minefield.

So you’ve got different reasons and different mindsets based on the ownership structure.

If there are partners in dispute, it’s not long before you can see difficulty in establishing consensus. And if one partner can’t buy out the other, you have to be extremely tactful. More than two partners flags even more need for diplomacy.

Some media proprietors are very realistic about the market, and especially their market. Others are unrealistic and if they’re flexible, we can generally work on a way in which a satisfactory deal can take place and both parties walk away satisfied.

I have never had a deal that I’ve done where the seller hasn’t been happy after the money was placed in their bank account. And most of these parties have generally maintained contact, even if they’re out of the business.

I’m very upfront. I don’t want to be engaged by any individual or organisation by promising them something that I don’t believe is possible.

LC: And I guess there’s that benefit of having you as a third party involved in selling the brand, because you have that objectivity.

JB: I agree with that, but it gets back to the consultancy side of things. I’ve had a very successful media career and made many contacts. My IP developed over many years is shared with those who take me on and I generally assist in developing new features for their enterprise if the assets aren’t sold. I’m not a salesman selling a brand, I’m a consultant that can look for value in a brand.

Alternatively, if there’s a desperation to sell the brand, we can work in such a way that we don’t look desperate. And we can build a solid proposition behind it, so there’s a lot of different ways to skin the cat.

LC: If you could give one piece of advice to publishers navigating the current media market, what would it be?

JB: The reality is, anyone can be a publisher/media communicator/influencer nowadays. We know that it’s cheap and simple to set up a social media operation, build a website shopfront, or buy email lists and compete for the dollar. In addition to that increased competition, there’s Facebook and the other media giants now taking a major slice of advertising and marketing revenues.

The media landscape has undertaken a huge change and is forever evolving with new opportunities and new entrants. And I think that you need creativity, realistic vision and an understanding of the market you wish to address, combined with confidence and enthusiasm, and a few dollars to maintain the growth.

Plus a lot of patience. You need some sort of longevity.

…you need creativity, realistic vision and an understanding of the market you wish to address, combined with confidence and enthusiasm, and a few dollars to maintain the growth.

To succeed I think it helps to anticipate the future of the sector you are serving, do some risk analysis and forward planning over short periods taking into account market forces and the micro and macro elements that will impact your business plan and objectives (who could have anticipated COVID-19).

Align these with short and medium term goals. Think of an exit strategy from the start, and adjust as you go, keeping in mind the keys to success. And get yourself a good, valued and trusted mentor.

The only place you find success before work is in the dictionary. Nothing comes easy.

For more information about John Blondin’s services, visit the Media Titles website.